Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

What would you do with ten extra hours a month?

Maybe you’d catch up on work, or take a day off to spend with the family.

However you spend that time is better than fighting with payroll. And yet, the average small business owner spends hours pushing paperwork through each pay period.

At tax time, it’s even worse.

It doesn’t have to be this way.

The best payroll services streamline the process of paying your employees by automating most of the time-consuming tasks. When its time to cut checks, you have the tools you need to stay on top of taxes, benefits, paid time off, and so on.

Nobody likes payroll surprises. Make sure it’s easy for you to get people paid on time, every time, with as little busy-work as possible.

In this post, I’ve reviewed the top six solutions on the market today and included a short guide to help you evaluate your options. Keep reading to find the best payroll service for your specific needs.

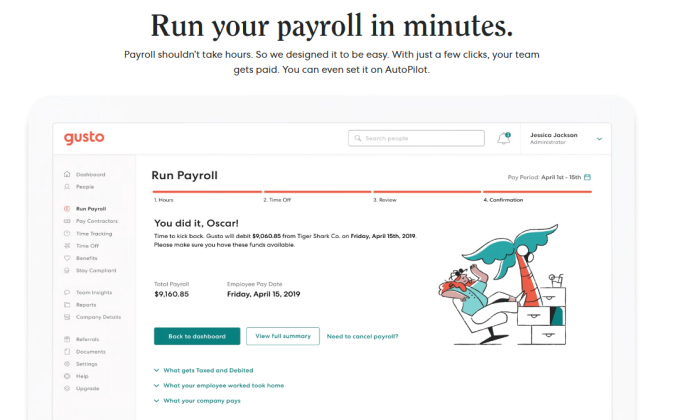

#1 – Gusto Review — Best for Remote and New Businesses

For startups and small businesses with a remote workforce, Gusto is going to be the easiest way to take care of essential payroll and HR services.

Gusto is cloud-based and mobile friendly. Run payroll from any device with internet access, wherever you are.

It’s a full-service platform, which means Gusto takes care of tax filings, health benefits, and employee retirement plans. For companies where people aren’t coming into the office, having all this information in a centralized, easy-to-use platform is a boon.

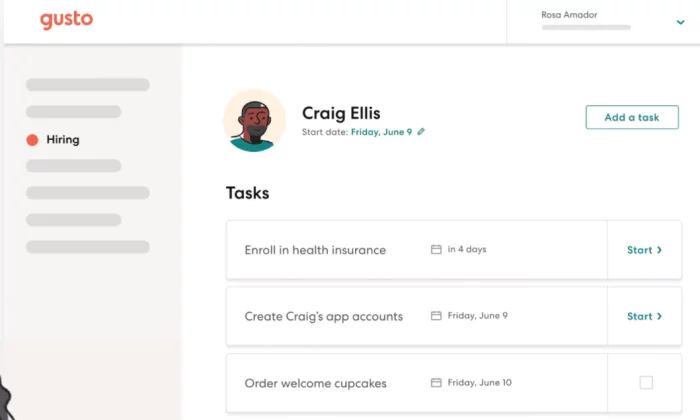

Gusto makes remote hiring and onboarding is a breeze. Employers build an onboarding checklist and send the new hire an invitation.

Employees complete each step of the simple process. They enter bank information directly into Gusto, so you never have to worry about sending sensitive data over email.

Once the employee sets up their account, everything they need is self-service. They can see all of their pay stubs and documents. Employees quickly gain confidence on the friendly, approachable platform.

The ease-of-use is really important to teams without any on-site training or coaching. Plus it’s going to eliminate busy work for you.

You never have to hunt down someone’s W2 again. As soon as it’s available, employees are notified and get on-demand access.

Coordinating remote work is hard enough without having to deal with multiple middlemen to answer basic questions about payroll. Gusto makes everything transparent, which saves time and frustration for employers and employees alike.

Gusto has a growing list of more than 50 integrations with popular tools remote teams depend on. Connect to accounting software like Xero and QuickBooks or time tracking software like QuickBooks Time (formerly TSheets), Deputy, and Homebase.

Every integration cuts down on the information your teams are entering manually. Employees clock out and the data syncs immediately with your payroll.

This creates fewer opportunities for errors and miscommunications, which can easily go unnoticed when people aren’t sharing an office.

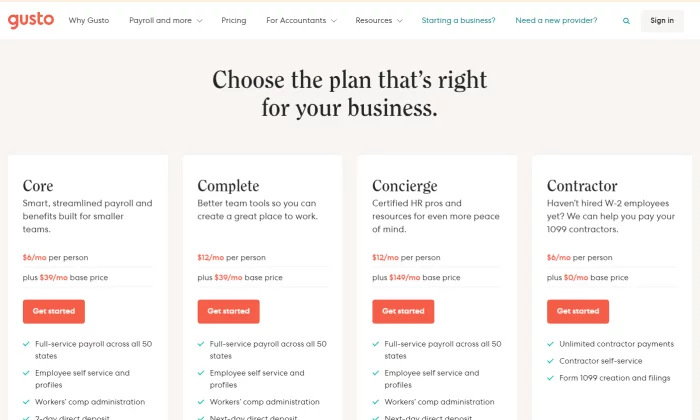

With Gusto, the features you get depend heavily on which of their plans you choose:

The pricing for Gusto includes a monthly base price plus a per-employee charge:

- Core: $39/month + $6/employee

- Complete: $39/month + $12/employee

- Concierge: $149/month + $12/employee

- Contractor: $0/month + $6/employee

Gusto’s Core plan gives you full payroll tax service in any state, as well as access to direct integrations with time tracking and accounting tools. This product is all that smaller remote teams will need.

The Complete plan has a higher cost per employee than Core and gives you a greater degree of visibility and control over your payroll processes. You’ll get project and workforce costing along with customizable onboarding tools.

Gusto customer support has a very good reputation, regardless of the plan you choose. However, the Concierge plan gives you access to certified HR pros who can help companies navigate complex tax and benefit scenarios.

This is a really great option for companies that work with 1099 employees. With Contractor plans, you pay $6 per each worker. All the tax stuff is handled, and your contractors get the same great self-service features as your employees.

For large, established, enterprise companies, Gusto is probably going to be too light. They aren’t able to handle health benefits in every state, for example, and that platform isn’t going to run as smoothly if you have over 100 employees.

This is the tradeoff of having such an easy platform to use. For new businesses and remote teams, Gusto is everything they need and nothing they don’t.

The guided onboarding and intuitive platform ensure that everyone gets off on the right foot, even if there’s no traditional HR department to oversee the process. Add to that the unlimited chat, email, and phone support, and you have the complete payroll toolkit for small business.

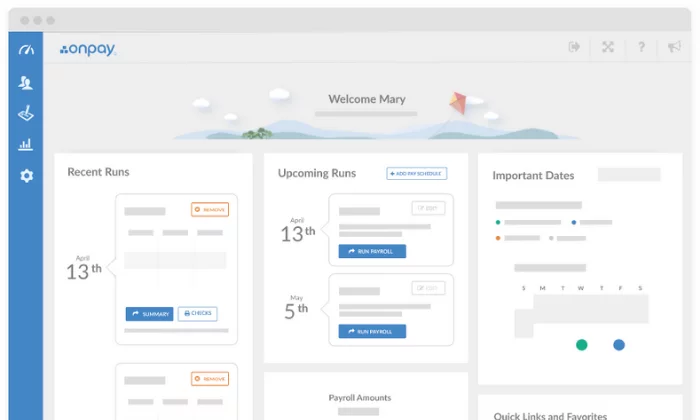

#2 – OnPay Review — Best for Simplifying Complicated Payroll

A lot of companies end up hiring a full-time payroll person once things get too complicated. A cheaper, easier alternative is to get OnPay.

This is an affordable solution that takes all of the complexity out of processing payroll. Anyone can learn how to run OnPay. It’s that simple.

There is one pricing plan with one low monthly rate and you get access to every payroll capability OnPay offers. No strings attached.

Say you have a business of less than 50 full-time employees and you want to offer a qualified small employer health reimbursement arrangement (QSEHRA). This is a good way to attract talent without having to offer a complete benefits package, but it can be a little tricky for a non-accountant to set up.

With OnPay, it’s easy to designate and track QSEHRA for payroll. Other providers don’t have this and you’ll be stuck trying to create a workaround or hiring someone to set it up for you.

These are just a few examples, but it’s true for Form 943 workers and other less common payroll scenarios that can easily trip up business owners.

In fact, OnPay provides special modules for restaurants, farms, churches, and other organizations that can’t depend on traditional payroll templates to get things right.

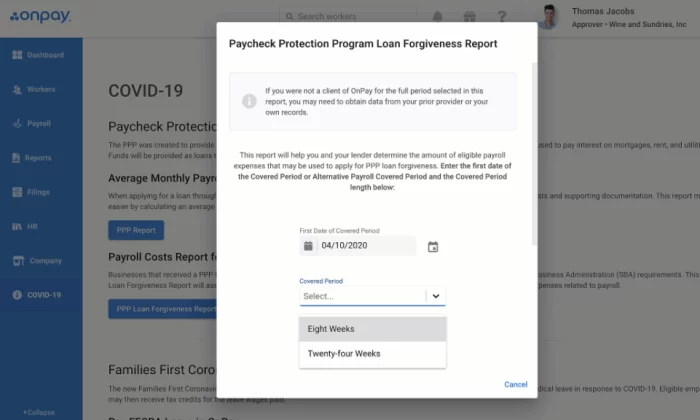

None of these capabilities cost you extra, and you can count on OnPay to keep providing new services. During the pandemic, they made it as simple as possible for companies to apply for the Paycheck Protection Program (PPP):

Instead of having to wade through the complex government regulations, companies using OnPay could follow simple steps to complete their PPP application.

OnPay is easy to navigate. It demystifies both common and edge-case payroll problems that trip up the average user. And if you run into issues, you can reach out to the OnPay customer service team. They are known for expert advice and solving problems quickly and that quality of support comes with no extra charge.

Unemployment insurance, garnishments, multiple pay schedules, PTO—OnPay has you covered. Getting set up is not hard and you can reach OnPay by phone, email, and chat if things don’t make sense.

OnPay doesn’t have any annoying limits. With every subscription, you get:

- Unlimited monthly payroll runs

- W-2 and 1099 capabilities

- Automatic tax calculations and filings

- Employee self-service onboarding and dashboards

- Intuitive mobile app for management on the go

- PTO, e-signing, org charts, and custom workflows

- Integrated workers’ comp, health insurance, and retirement

- Multi-state payroll

For employers who can’t stick with a routine payment schedule, the unlimited payroll runs are a must. You won’t have to think about extra fees for 1099 workers or upping your subscription to get more HR features. Pay any employee in any state any time you want.

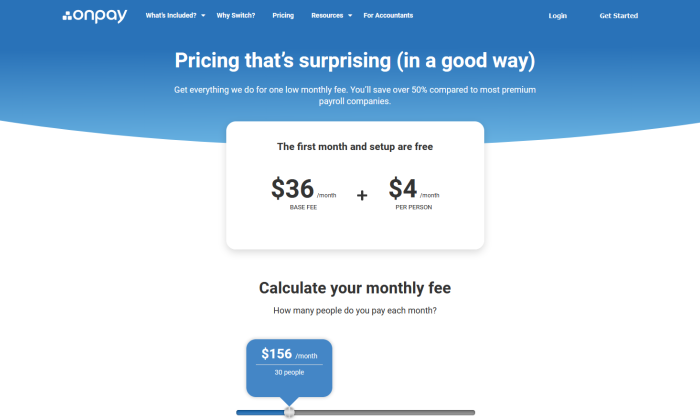

Pricing for OnPay is simple to calculate. Take their base rate of $36 per month and add $4 for each employee you have. So, using OnPay for an organization of 30 people will run you $156 per month.

OnPay offers free account migration and helps setting up the integrations you need. If you are tired of confusing payroll and hidden charges, get in touch with OnPay today.

If you switch, your first month of OnPay is free.

Try OnPay free for 30 days to see if it’s right for you!

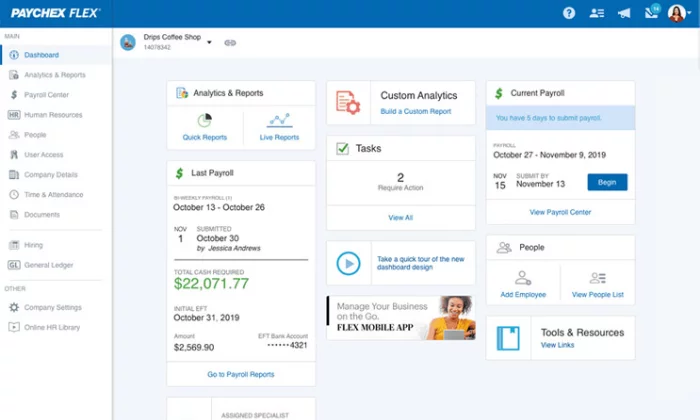

#3 – Paychex Review — Best for Replacing Your Current Payroll Service

Lots of companies switch from an outside payroll/accounting service to Paychex Flex to streamline HR.

Stuck with having to request filings and payroll information? If you’ve grown to the point where the middleman has become a bottleneck, that won’t work anymore.

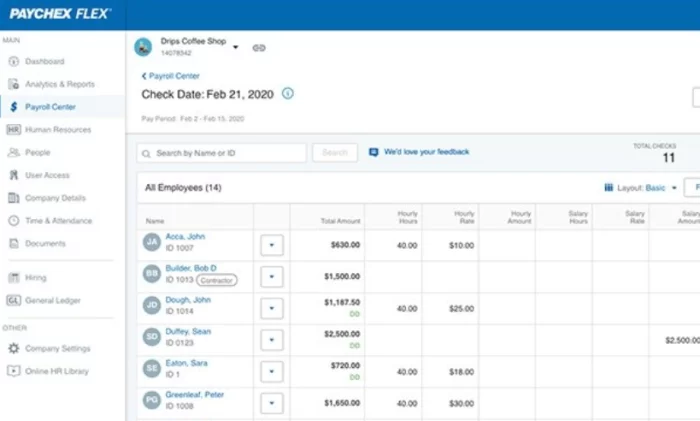

Paychex provides self-service access to both the employer and employee.

Now, you can get the same on-demand access with some of the lighter (and less expensive) options like OnPay. The thing is, OnPay doesn’t replace that outside expertise.

With Paychex Flex, you get a dedicated payroll specialist. This will be your single point of contact at Paychex, which is much better than playing the old customer service lottery.

Don’t get me wrong, Wave and OnPay have excellent customer service reps, but they can’t stand in for someone who knows your business. That knowledge was a big part of the value from hiring an outside expert and no customer service call center can replicate that.

In addition to getting a payroll expert in your corner, you get the Paychex platform, which will accommodate any conceivable tax or benefits scenario.

Instead of having to figure out workarounds, you can customize deductions and earnings with a few clicks. Paychex makes it easy to maintain accuracy and figure out when something’s wrong.

I really like the flexible views, which let you drill down into individual payroll records, list out your employees, or switch to a grid-view for easy data entry:

The versatility of the platform, the depth of payroll capabilities, and the dedicated customer service rep combine to make Paychex Flex the best solution for replacing your old outside payroll service.

Enrolling employees in a retirement plan, for example, is a common reason that business owners have to hire help. With Paychex, you have a wide range of plans to choose from and an easy process to get set up.

Employees can check their retirement plan and contributions from their browser or phone and use the retirement calculator to track their savings.

There are also 160 pre-built reports and dashboards to help owners stay informed about the company’s financial health. Much of the insight and perspective of that would normally be supplied by an outside advisor is built right into the platform.

Some of the other highlights include:

- Recruiting and onboarding

- Performance and learning management

- Powerful real-time analytics

- Payroll automation features

- Direct deposit, paper checks, and paycards

- Salary, hourly, and contract workers

- Paycheck garnishments

- PTO and benefits management

- Job costing and labor distribution

What if you don’t need every capability? That’s okay, as Paychex Flex comes is available at three different tiers: Select, Pro, and Enterprise. You’ll have to get in touch with sales for pricing, as it’s not on the website.

Paychex Flex Select is aimed at businesses with basic payroll needs. You don’t get the self-service onboarding, which is useful, but you do get the dedicated payroll specialist to help with any problems you have.

With Paychex Flex Pro, you get access to the full platform. This includes additional support for workers compensation administration and state unemployment insurance. With the Enterprise plan you can build out customized reports and additional tools to manage HR compliance.

Paychex has 191 integrations with banks, employee retirement plans, and of course, tons of the popular software applications associated with payroll. This allows companies to oversee a centralized system that tracks employees from recruitment to retirement.

With Paychex Flex, companies can keep everything in-house. The platform makes payroll a cinch and gives business owners the insight and confidence they need to move forward without an outside service.

Contact their sales team for a custom quote to get started!

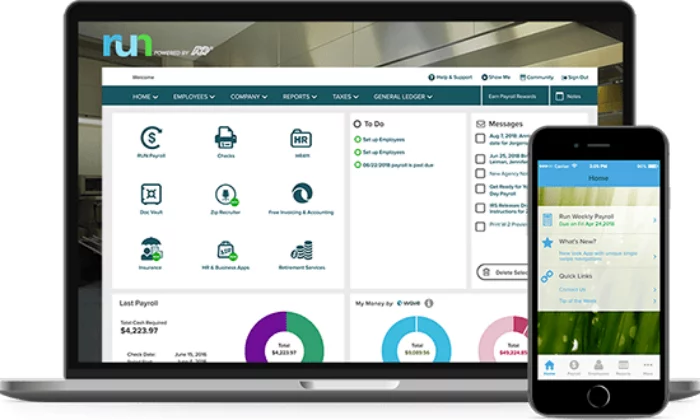

#4 – ADP Review — Best Bundled HR/Payroll Service

ADP is a one-stop shop for companies that want to handle payroll and HR through a single provider. Over 700,000 businesses in more than 140 countries entrust ADP, which has earned a very strong reputation over seven decades of service.

With some payroll services that might be cheaper than ADP, you can run into annoying limits. Wave, for example, only offers tax services in select states. Gusto is a good option to handle payroll and HR, but only if you are in one of the 38 states that the company offers coverage.

Plus, you only get HR compliance assistance with Gusto’s Concierge plan, whereas ADP makes options available regardless of what plan you are on.

When you are looking for bundled HR features, you may have complex payroll issues that a lighter platform like Gusto will struggle with. ADP can tackle any situation you can imagine.

Once you get set up, all payroll taxes are calculated and paid with minimal effort on your part. The system is set up to simplify the most complex retirement package or unique paid-leave package. ADP stays up to date with changing regulations, which keeps your books compliant and protects you from penalties.

Paychex is another full-service payroll provider with a deep feature set. When it comes to HR, however, Paychex is going to integrate with third-party services. ADP handles everything without the help of outside vendors.

If you just need payroll handled, ADP will knock it out of the park. Should you want more HR responsibilities taken off your plate, ADP can help with:

- Time & attendance

- Workforce management

- Recruiting & hiring

- Management & growth

- Benefits administration

- Retirement

- Group health insurance

- Business insurance

- Workers compensation

Unlike other payroll providers that connect you to HR service, ADP can serve as a full-scale HR outsourcing service or professional employer organization (PEO).

This is great for companies that want to minimize their HR workload or outsource their entire burden. While some of the other solutions on my list will help you streamline processes, ADP can take them over all together.

ADP has a wide range of payroll service offerings for companies of different sizes. First, you have to select your package based on company size:

- Small Business Payroll: 1-49 employees

- Midsize to Enterprise Payroll: 50+ employees

ADP’s small business option is a sleek platform that comes with all the essential payroll and HR features you’d expect. Instead of trying to water down their enterprise offering, ADP created a separate interface that’s not freighted by the tools larger companies need.

The midsize to enterprise offering is a much deeper platform built to manage payroll regardless of how large your organization grows.

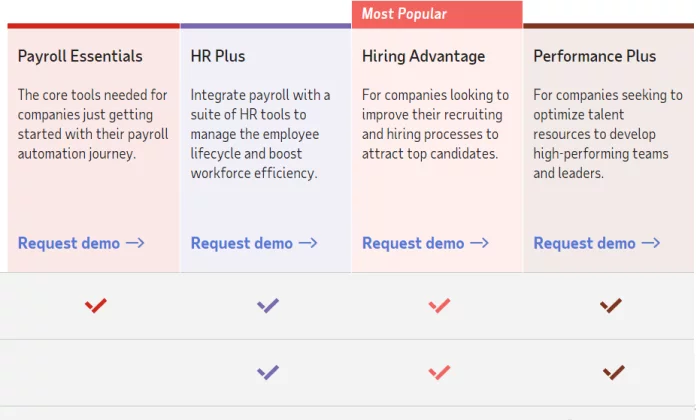

There are multiple plan options for both the Small Business Payroll and Midsize to Enterprise Payroll packages. You can see the small business plans laid out below:

Basically, the lowest tier is payroll only and you get more HR tools with higher plans. It’s the same story for the midsize/enterprise package.

You’ll have to get in touch with ADP to get a quote for how much the service costs.

Hundreds of thousands of companies depend on ADP for payroll and HR. If you are running into limits with another service or if you are tired of dealing with multiple vendors, choose ADP and never look back.

Request a free quote to see if ADP is right for you today.

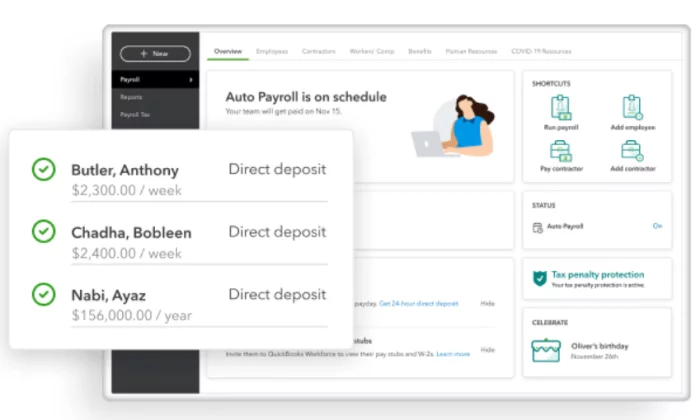

#5 – Quickbooks Payroll Review — Best If You Already Use Quickbooks

When QuickBooks Payroll launched, people who used QuickBooks’ popular accounting software were like, “Yes, please.” It almost makes too much sense.

The integration is truly seamless. Quickbooks Payroll works through the same online platform. You can consolidate payroll, invoicing, cashflow, and expenses in a single place. All of this financial data syncs and updates automatically.

If you have experience with QuickBooks Online, everything is going to be legible to you. It’s a straightforward platform in its own right, but if you are already comfortable with the accounting solution, you can step right and get to work.

QuickBooks Payroll is optimized for up to 50 employees (including contractors) with a limit of 150. So it’s not for larger firms.

While size is a limit, complexity is not. QuickBooks Payroll has a robust set of capabilities that work in all 50 states.

Full-service payroll comes with every plan they offer. Once you enter payroll data into the system, QuickBooks processes payroll and takes care of all your tax filings.

- Unlimited payroll runs

- Automatic payments after the first run

- Health benefits

- 401(k) plans

- Wage garnishments

- Next-day direct deposit

- 24/7 live chat support

- Workforce mobile app

Employees really appreciate the next-day direct deposit, which is faster by a few days than some of the other popular payroll services. With premium QuickBook payroll plans, you can actually get a same-day direct deposit.

The customer service options are decent compared to other options. There’s live chat any time you need it and phone support during business hours. They also offer phone support on Saturday’s for a few hours.

The Workforce mobile app is great for remote and on-the-go employees. This is especially true if you have workers in the field because QuickBooks Payroll integrates with QuickBooks Time (formerly TSheets), one of my favorite time clock software options.

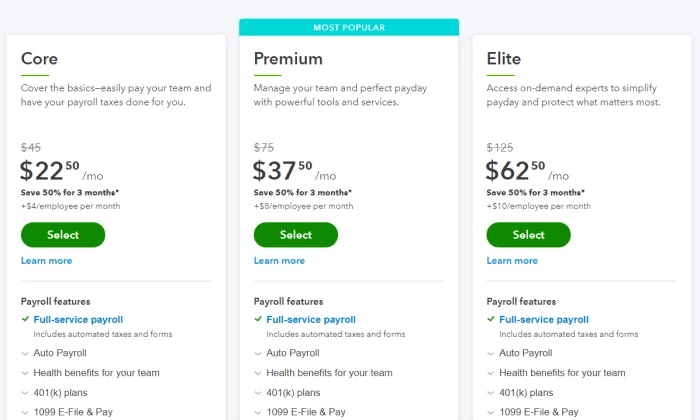

Pricing for QuickBooks Payroll breaks down into three tiers:

The Core plan includes full-service payroll, which automates all your taxes and forms. It also covers 401(k) plans and health benefits.

With the Premium plan, you get access to more HR support, workers’ compensation administration, and QuickBooks Time is included for anywhere employee time-tracking.

Elite plans come with prioritized customer support available 24/7. They’ll also help you deploy the QuickBooks to ensure everything is set up right.

The reason QuickBooks payroll isn’t my overall choice is that it’s less budget-friendly than some of the comparable solutions like OnPay and Gusto. It’s a little more expensive out of the box and there are some annoying fees, like paying extra for 1099 workers.

But, if you are already set up on QuickBooks, this is an appealing option. It’s going to dovetail right into your workflows.

It can be much more effective for businesses like restaurants, retail, and construction companies that use QuickBooks for their inventory and bookkeeping. Keep everything in one place. Gusto and OnPay aren’t going to do that for you.

Try QuickBooks Payroll free for 30-days and see if it’s the payroll puzzle piece you’ve been missing.

#6 – Wave Payroll Review — Most Affordable for DIY Taxes

If you are on a tight budget, Wave Payroll might be your best option.

Especially if you are the do-it-yourself type.

This is because Wave doesn’t offer full-service payroll in all 50 states. If they don’t offer tax service in your state, you pay a lot less.

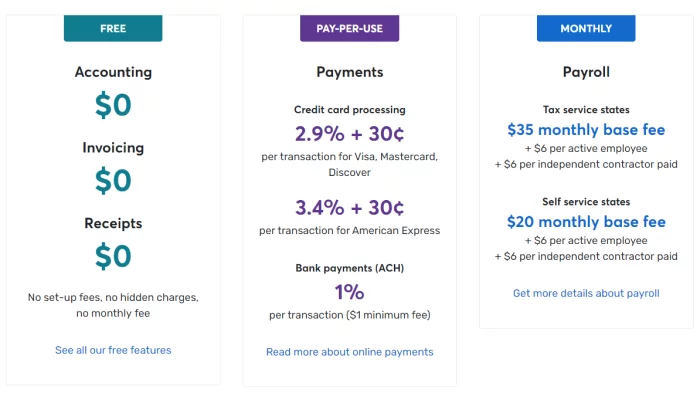

You don’t get to choose–tax service is either baked into the price, or unavailable in your state. Here’s how Wave Payroll pricing breaks down:

- Tax service state: $35/month base fee + $6/employee

- Self service state: $20/month base fee + $6/employee

These are the states where tax service is available: Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington and Wisconsin.

Pricing is predictable, too. It’s $6 per active employee or independent contractor. There’s no hidden fees, no extra charges.

Wave Payroll is affordable in the tax service states and a real bargain everywhere else.

The obvious downside is that you have to pay and file your taxes.

Here’s the thing: Wave makes it so easy to figure out what you need to do.

If you are used to doing payroll taxes yourself, Wave is going to feel like stepping into a Ferrari.

But even if you have never laid eyes on a ledger, the DIY option is well within reach.

Wave Payroll is an excellent teacher. It’s easy to find your way around, even if you don’t know what everything means right away. There’s a ton of guidance and the documentation is really helpful.

Learning is the best part of doing things yourself. With Wave Payroll, explanation and clarification is always a click or two away.

The live chat is phenomenal. It feels like the human on the other end is really invested in improving their service. The quick response is critical to get you through first-time jitters and reservations, to say nothing of preventing errors.

Some of the features that take no time to master include:

- Automatic journal entries (if you use Wave Accounting)

- Self-service pay stubs and tax forms for your employees

- Workers’ compensation management

- Basic payroll reporting

- Automatic year-end tax forms (in tax service states)

- Timesheets for PTO and accruals

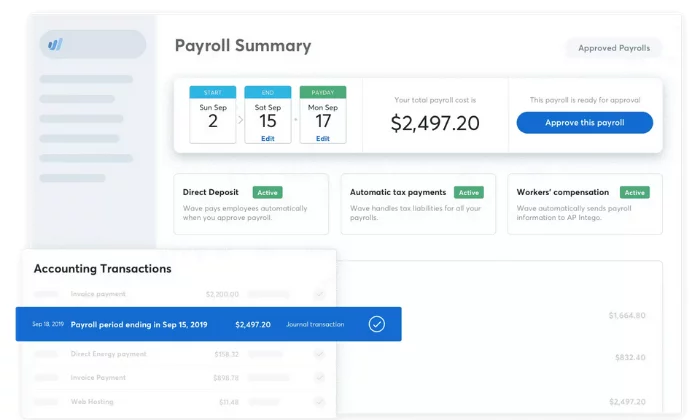

Wave Payroll works best with Wave’s accounting software, which is free forever.

If price is a factor in your decision, this makes Wave really attractive. There are fees for accepting payments, but you will never have to pay for accounting or invoicing again.

Wave keeps prices low across the board. Small businesses will be able to handle most, if not all of their finances through Wave. Doing the same thing with QuickBooks would be a lot more expensive.

You can also temporarily deactivate your Wave account and stop paying. This can be really helpful for seasonal businesses.

There’s just a lot of freedom with Wave, and very few charges. It gets out of your way and lets you get payroll done.

As I said, Wave accounting is free forever, and you can test drive Wave Payroll with a free demo here.

What I Looked at To Find the Best Payroll Service Providers

I’d love to say, “Here’s the easiest payroll service to use,” but I can’t.

It depends on your situation. Two dry cleaners in the same town might have completely different experiences with the same service, based on how they pay their employees or the other business software they use.

How many times do you want to switch payroll services?

As few as possible would be my guess.

Here are the major criteria you need to consider in order to pick a payroll service that’s actually going to make payroll a breeze.

Payroll Capabilities

Who are your employees and how do you pay them?

Before you evaluate your options, map out every factor that could possibly influence payroll. This may include:

- Different types of workers (W2, 1099, hourly, salaried)

- Tax liability (federal, state, and local)

- Employee benefits (retirement plans, healthcare, PTO, stock options)

- Pay cycles (bi-weekly, monthly, unlimited)

- Payment (direct deposit, paper checks, Venmo, Apple Pay)

- Garnishments (child support, credit card debt, student loans)

These are just some of the major factors to consider. If your business is subject to unusual taxes or regulations, double-check with the vendor to make sure you’re covered.

It’s going to be tricky to keep the books accurate if you have to work around the system rather than as it’s designed.

The more mature payroll solutions, like ADP and Paychex, are going to support every conceivable tax and benefit situation. Lighter tools such as Gusto might not be able to handle complex retirement packages as easily.

If you don’t need all the capabilities of ADP or Paychex, the extra features are probably going to get in the way. Many small businesses can get everything they need from Gusto in a much more user-friendly and affordable platform.

Integrations

When your payroll service plays nice with your other business software, life is great. You don’t have to enter the same information in multiple places. In fact, a lot of data entry will be automated.

New hires are automatically on payroll. Whenever they clock in or record their tips, the information is all tracked and accounted for without any oversight on your part.

Integration with accounting, employee scheduling, time tracking, and HR software is a must. It really defeats the purpose of payroll software if you are constantly having to enter information manually.

Gusto is a standalone service, but it has direct integration with 52 of the most popular accounting, point-of-sale, time tracking, and business operations software.

Alternatively, you could look at bundling multiple solutions from the same provider. The payroll service from ADP is just one piece of a suite of financial and HR tools they offer. Quickbooks Payroll and Wave Payroll are the same way.

Obviously Wave Payroll and Wave Accounting work together seamlessly. If you are already using one, it makes a lot of sense to use the other.

Customer Service

Managing taxes and benefits is hard on a good day. Congress makes one small change to the law and suddenly everyone has to rework how they do payroll to stay compliant.

Is your payroll service on top of these changes? Can they take care of their end and help you sort out problems on yours?

If you are hiring people in multiple states, it’s so easy to make a mistake. Is your payroll service going to catch it and alert you before the IRS penalizes the company?

Having a payroll service that responds quickly can solve a lot of problems before they start.

Another important aspect to consider is onboarding, both for your company and your employees.

Does the vendor help you move your payroll data over if you are switching services mid-year? The more help they provide, the quicker and more accurate the transition will be.

Gusto and OnPay have a wonderfully simple employee onboarding process that is virtually hands-off for the employer. Beyond approvals, there’s little that isn’t handled by the employee and customer service.

Finding a payroll service that really supports you and your employees can make the difference between a frictionless experience and constant frustration.

Summary

For most users, Gusto and OnPay are my top recommendations.

They’re all excellent for small and fast-growth businesses with the ability to scale to match your needs. Plus, they’re affordable and easy to use.

However, different businesses require different solutions. Use the considerations we talked about as you go through the process of choosing the best payroll services for your business.

To recap all of my top choices:

- Gusto – Best payroll service for remote and new businesses

- OnPay – Best payroll service for simplifying complicated payroll

- Paychex – Best for replacing your current payroll service

- ADP – Best bundled HR and payroll service

- QuickBooks Payroll – Best payroll service if you already use QuickBooks

- Wave Payroll – Most affordable payroll service for DIY taxes

Gusto and OnPay are phenomenal, but if you are the DIY-type, Wave might be the choice for you. And if you are looking to outsource more than the essential HR tasks, ADP is a very attractive option.

The only bad choice is sticking with spreadsheets, or a payroll provider that’s not working.

Save time, eliminate mistakes, and get back to running your business with dependable payroll service by your side.

What payroll services do you prefer?

The Best Payroll Services (In-Depth Review)

Publicado Primeiro em Neil Patel

Nenhum comentário:

Postar um comentário