Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

What would you do with ten extra hours a month?

You’d probably work on growing your business, right? Maybe you’d spend it creating new marketing campaigns to generate more revenue. Perhaps you’d take half a day off to spend time with your family.

Regardless, the average small business owner spends five hours every pay period running payroll. That adds up to 21 full work-days a year.

But thankfully, that’s not what your payroll process has to look like.

The best payroll services simplify and streamline the process of paying your employees. They automate time-consuming tasks and give HR the tools they need to stay on top of taxes, benefits packages, paid time off, and other payroll factors.

Choosing the right payroll service is important, because they all do things a little differently. Let’s talk about the major features you are looking for and how to evaluate the top services available today.

The 6 Best Payroll Service Options for 2021

- Gusto – Best payroll service for small businesses

- OnPay – Most flexible payroll service

- Paychex – Best for larger organizations

- ADP – Best payroll service with built-in HR

- QuickBooks Payroll – Best for QuickBooks integration

- Wave Payroll – Most affordable payroll service

What I Looked at To Find the Best Payroll Service Providers

I’d love to say, “Here’s the easiest payroll service to use,” but I can’t.

It depends on your situation. Two dry cleaners in the same town might have completely different experiences with the same service, based on how they pay their employees or the other business software they use.

How many times do you want to switch payroll services?

As few as possible would be my guess.

Here are the major criteria you need to consider in order to pick a payroll service that’s actually going to make payroll a breeze.

Payroll Capabilities

Who are your employees and how do you pay them?

Before you evaluate your options, map out every factor that could possibly influence payroll. This may include:

- Different types of workers (W2, 1099, hourly, salaried)

- Tax liability (federal, state, and local)

- Employee benefits (retirement plans, healthcare, PTO, stock options)

- Pay cycles (bi-weekly, monthly, unlimited)

- Payment (direct deposit, paper checks, Venmo, Apple Pay)

- Garnishments (child support, credit card debt, student loans)

These are just some of the major factors to consider. If your business is subject to unusual taxes or regulations, double-check with the vendor to make sure you’re covered.

It’s going to be tricky to keep the books accurate if you have to work around the system rather than as it’s designed.

The more mature payroll solutions, like ADP and Paychex, are going to support every conceivable tax and benefit situation. Lighter tools such as Gusto might not be able to handle complex retirement packages as easily.

If you don’t need all the capabilities of ADP or Paychex, the extra features are probably going to get in the way. Many small businesses can get everything they need from Gusto in a much more user-friendly and affordable platform.

Integrations

When your payroll service plays nice with your other business software, life is great. You don’t have to enter the same information in multiple places. In fact, a lot of data entry will be automated.

New hires are automatically on payroll. Whenever they clock in or record their tips, the information is all tracked and accounted for without any oversight on your part.

Integration with accounting, employee scheduling, time tracking, and HR software is a must. It really defeats the purpose of payroll software if you are constantly having to enter information manually.

Gusto is a standalone service, but it has direct integration with 52 of the most popular accounting, point-of-sale, time tracking, and business operations software.

Alternatively, you could look at bundling multiple solutions from the same provider. The payroll service from ADP is just one piece of a suite of financial and HR tools they offer. Quickbooks Payroll and Wave Payroll are the same way.

Obviously Wave Payroll and Wave Accounting work together seamlessly. If you are already using one, it makes a lot of sense to use the other.

Customer Service

Managing taxes and benefits is hard on a good day. Congress makes one small change to the law and suddenly everyone has to rework how they do payroll to stay compliant.

Is your payroll service on top of these changes? Can they take care of their end and help you sort out problems on yours?

If you are hiring people in multiple states, it’s so easy to make a mistake. Is your payroll service going to catch it and alert you before the IRS penalizes the company?

Having a payroll service that responds quickly can solve a lot of problems before they start.

Another important aspect to consider is onboarding, both for your company and your employees.

Does the vendor help you move your payroll data over if you are switching services mid-year? The more help they provide, the quicker and more accurate the transition will be.

Gusto and OnPay have a wonderfully simple employee onboarding process that is virtually hands-off for the employer. Beyond approvals, there’s little that isn’t handled by the employee and customer service.

Finding a payroll service that really supports you and your employees can make the difference between a frictionless experience and constant frustration.

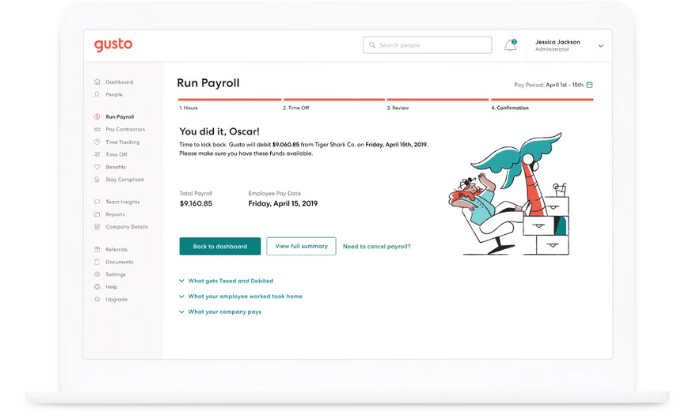

#1 – Gusto Review — The Best for Small Businesses

If you’re a small business looking for a simple payroll service, Gusto is a smart choice. And you’ll be in good company with more than 100,000+ other small businesses around the world.

Gusto makes onboarding, paying, insuring, and supporting employees as easy as possible. And they don’t call themselves a “people platform” for no reason.

They offer the right set of tools and services to make your life (and your employees’ lives) easier.

Running payroll takes just a few clicks, and you can enjoy unlimited payroll runs every month. Need to pay seven different contractors at different times? No problem.

Need to pay the same employees the same wages every pay period? You can set it up to run automatically without you having to lift a finger.

Plus, you get access to a wide variety of features, including:

- Automatic tax calculations

- Built-in time tracking capabilities

- Health insurance, 401(k), PTO, workers’ comp, and more

- Compliance with I-9’s, W-2s, and 1099s

- Employee self-service onboarding and dashboards

- Next-day direct deposits (on specific plans)

And the best part? It’s affordable.

If you don’t have W-2 employees, Gusto starts at $6 per contractor per month. But if you do have full-time or part-time employees, expect to pay a bit more. Their other paid plans include:

- Basic — $19 per month + $6 per person per month

- Core — $39 per month + $6 per person per month

- Complete — $39 per month + $12 per person per month

- Concierge — $149 per month + $12 per person per month

Gusto is perfect for most startups and small businesses. But, large companies with complex benefits packages and hundreds of employees may find it limiting.

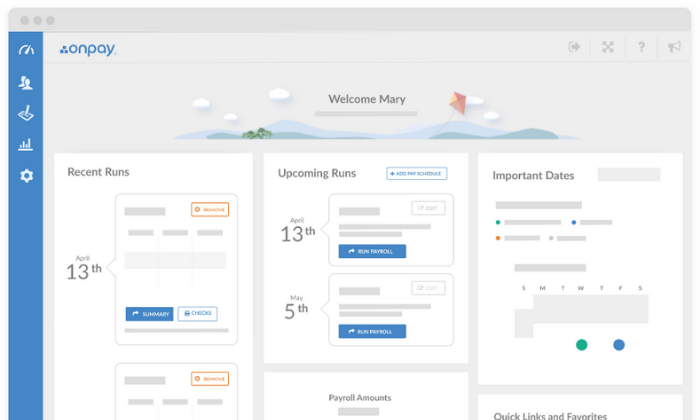

#2 – OnPay Review — The Most Flexible Payroll Service

If you’re looking for an all-in-one payroll system with transparent pricing and virtually unlimited flexibility, OnPay is an excellent choice.

Whether you’re a small company or a fast-growth startup, OnPay is versatile enough to suit your needs. Plus, you never have to guess how much you’re going to pay every month with their transparent pricing.

And you can rest easy knowing you have access to every feature OnPay offers regardless of the number of employees you have because they only provide one pricing plan.

Their software includes access to powerful features, including:

- Unlimited monthly payroll runs

- W-2 and 1099 capabilities

- Automatic tax calculations and filings

- Employee self-service onboarding and dashboards

- Intuitive mobile app for management on the go

- PTO, e-signing, org charts, and custom workflows

- Integrated workers’ comp, health insurance, and retirement

- Multi-state payroll

Plus, getting started is super easy. All you have to do is set up your account, add your employees, and start running payroll. Furthermore, OnPay automatically calculates and withholds taxes so you don’t have to worry about manual calculations or human error again.

They also offer specialized solutions for different industries, including nonprofits, restaurants, and farming/agriculture.

OnPay is $36 per month plus $4 per person per month. So, you can add new employees to the software for just a few dollars, making it excellent for fast-growing companies and small businesses alike.

And while OnPay can handle large companies with hundreds of employees, there are better enterprise options available. It’s most suitable for small businesses and fast-growth companies that need simple pricing and flexibility.

Try OnPay free for 30 days to see if it’s right for you!

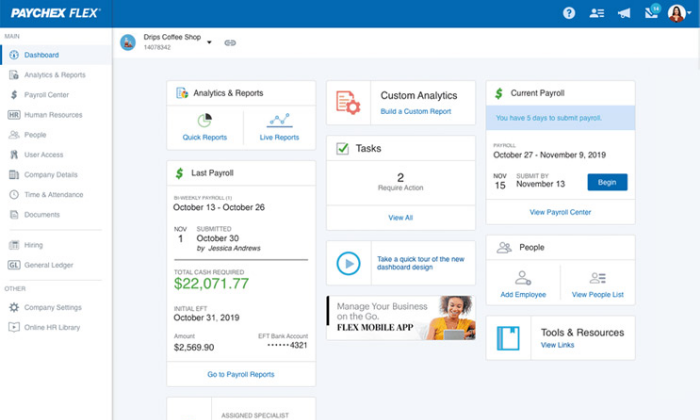

#3 – Paychex Review — The Best for Larger Organizations

Paychex is an excellent choice for businesses with more than 50 employees. They also offer low-tier plans for small businesses, but they’re quite limited compared to the other small business options on this list.

However, their midsize to enterprise plans are perfect for large companies.

The larger your business is, the worse small discrepancies and human errors affect your tax calculations. And wrong tax filings equal harsh penalties from the IRS, even if it was an accident.

So as a large company, it’s imperative to have a payroll service that adapts to meet your needs. Paychex is more than a payroll service. It’s a human capital management (HCM) system designed to help you save time and reduce errors.

Their enterprise plans include features like:

- Recruiting and onboarding

- Performance and learning management

- Powerful real-time analytics

- 100% employee self-service

- Payroll automation features

- Direct deposit, paper checks, and paycards

- Salary, hourly, and contract workers

- Paycheck garnishments

- PTO and benefits management

- Job costing and labor distribution

All of which are scalable for enterprises with thousands of employees (or as little as 50). Plus, Paychex services more than 650,000+ companies and has more than 50 years of experience in the industry.

So, you can rest easy knowing you’re in good hands.

With that said, getting started isn’t as easy as it is with some of the other options on this list. Because each deployment is tailored to your business, you can’t get going on your own. However, they do offer a team of specialists to help you get the ball rolling.

Contact their sales team for a custom quote to get started!

#4 – ADP Review — The Best for Built-In HR Features

ADP is the way to go if you’re looking for a payroll service with the most built-in HR features. It’s perfect for smaller companies without an HR department and growing/large companies looking to streamline the process.

ADP works with more than 700,000 businesses in 140+ countries, making it one of the most popular payroll services for businesses of all shapes and sizes.

They offer tailored solutions for small, midsize, and enterprise businesses, so you’re sure to find the perfect solution whether you have five employees or 1000+.

Their lower-tiered plans include basic payroll features like automatic tax calculations, employee self-service tools, a mobile app, PTO management, and complete compliance support.

However, ADP offers more than just basic payroll and HR. They also include time tracking, talent recruitment, HR consulting services, advanced employee benefits, and the option to outsource your entire payroll/HR department.

You can also get unique benefits, like personalized training, legal assistance, background checks, and interview scheduling too.

Furthermore, ADP offers industry-specific solutions for nine different industries, including:

- Restaurants

- Construction

- Healthcare

- Manufacturing

- Retail

- Nonprofits

Note: ADP pricing isn’t available online, so it may not be suitable for micro or small businesses interested in getting started quickly. If you need something fast and straightforward, my #1 recommendation is Gusto.

Request a free quote to see if ADP is right for you today.

#5 – Quickbooks Payroll — The Best for QuickBooks Integration

Quickbooks Online is one of the most well-known accounting tools on the market. And if you’re already a user, QuickBooks Payroll is an excellent addition to your tech stack.

The two tools integrate seamlessly, making account reconciliation and tax season a breeze.

Furthermore, QuickBooks’ payroll system works in all 50 states. So, whether you have a remote team or work with contractors across the country, you don’t have to worry about making errors or mishandling taxes.

You can also rest easy knowing your federal, state, and local taxes are automatically calculated plus paid for you every time you run payroll. Plus, the entire process is easily automated after your first round of payments.

With QuickBooks, you get a full-service payroll system regardless of the plan you choose.

And the user interface is aesthetically pleasing with direct deposit payments landing in your employees’ bank accounts within 24 – 48 hours.

The Core Plan starts at $45 per month, plus $4 per employee per month. It includes:

- Full-service payroll with unlimited runs

- Automatic payments after the first run

- Health benefits

- Wage garnishments

- Next-day direct deposit

- 24/7 live chat support

- All 50 states

So, even their most basic plan includes everything you need to simplify your HR and payroll processes.

But if that isn’t enough, their advanced plans include:

- Premium — $75 per month + $8/employee per month

- Elite — $125 per month + $10/employee per month

Get 70% off your first three months to take QuickBooks Payroll for a test drive today!

Note: 1099 contractors and freelancers aren’t included. It comes as an add-on with additional monthly fees. So, this isn’t the most affordable choice if you frequently handle contractors or freelancers.

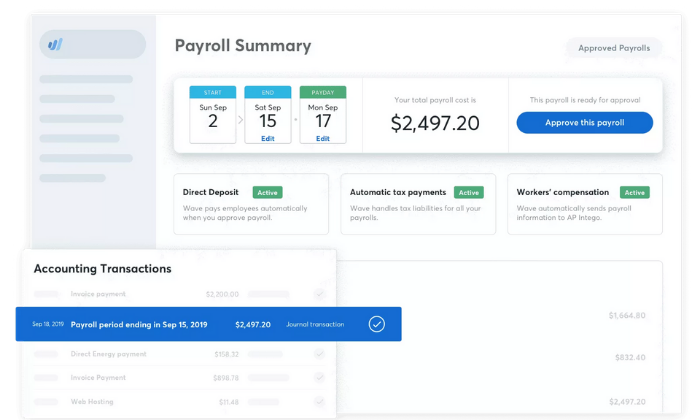

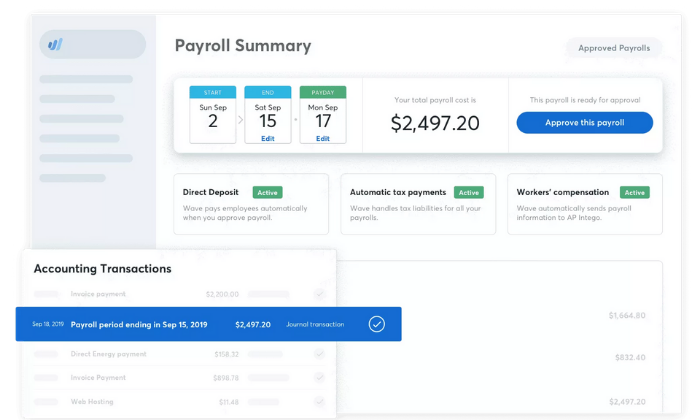

#6 – Wave Payroll Review — The Most Affordable Payroll Service

If you’re on a tight budget, Wave Payroll is an affordable payroll option. Wave also offers numerous other small business tools for free, including invoicing, accounting, and receipt management.

The different apps integrate seamlessly to create an affordable small business accounting and payroll solution.

With Wave, getting started takes just a few minutes, and running payroll goes even faster. Plus, they offer a 100% accuracy guarantee. You can also pay hourly, salary, and contractors and automatically generate the right tax forms.

In some states, Wave automatically files and pays your state/federal payroll taxes for you. However, in those states, Wave’s services are more expensive.

You also get access to features, like:

- Automatic journal entries (if you use Wave Accounting)

- Self-service pay stubs and tax forms for your employees

- Workers’ compensation management

- Basic payroll reporting

- Automatic year-end tax forms

- Timesheets for PTO and accruals

While Wave is one of the most affordable payroll services, it doesn’t sacrifice functionality and essential features. Despite being cheaper than the other options on this list, you still get all the essentials you need to run payroll for your small business.

In tax service states, Wave is $35 per month + $6 per contractor/employee per month. This service isn’t necessarily cheaper than the other options on this list.

But, it’s still a great option if you’re a small business owner looking for a simple payroll solution.

However, it’s $20 per month + $6 per contractor/employee per month in self-service states. At this price, it’s easily the cheapest option with the most features available.

And don’t forget that Wave Payroll seamlessly integrates with Wave’s free accounting and invoicing software as well.

So, if you don’t yet have accounting software, this is a smart choice.

Try Wave Payroll free for 30 days to see if it’s right for you and your business!

Summary

For most users, Gusto and OnPay are my top recommendations.

They’re all excellent for small and fast-growth businesses with the ability to scale to match your needs. Plus, they’re affordable and easy to use.

However, different businesses require different solutions.

So, don’t forget to use the considerations we talked about as you go through the process of choosing the best payroll services for your business.

What payroll services do you prefer?

The post The Best Payroll Services (In-Depth Review) appeared first on Neil Patel.

The Best Payroll Services (In-Depth Review)

Publicado Primeiro em Neil Patel

Nenhum comentário:

Postar um comentário